This relationship can be expressed in. Current liabilities are best paid with current assets like cash cash equivalents and.

Current Ratio Current Assets Current Liabilities Learn Accounting Online Youtube

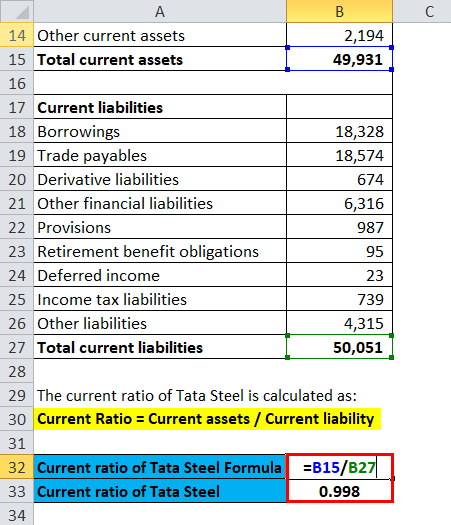

Current Ratio Formula Calculator Excel Template

/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

Current Ratio Definition

The working capital ratio is important to creditors because it shows the liquidity of the company.

Current ratio formula. A higher current ratio indicates strong solvency position of the entity in question and is therefore considered better. The current ratio is a liquidity ratio that measures whether a firm has enough resources to meet its short-term obligations. What is the formula for the Current Ratio.

Current ratio is a liquidity ratio that measures the capability of a business to meet its short-term obligations that are due within a year. Know about current ratio formula and example. To help identify the short term liquidity of a firm this ratio is used.

This means that a company has a limited amount of time in order to raise the funds to pay for these liabilities. The current ratio of TCS is 290. Current ratio Current assets Current liabilities.

Current Ratio Formula Table of Contents. Quick ratio Quick assets Current liabilities. Cash and cash equivalents.

A companys stakeholders as well as investors and lenders use the quick ratio to measure whether it can meet current short-term obligations without selling fixed assets or liquidating inventory. The formula for current ratio is. The current ratio is a popular financial ratio amongst the research analysts to measure.

The current ratio is an important measure of liquidity because short-term liabilities are due within the next year. Current assets include cash and cash equivalents marketable securities short-term receivables inventories and prepaymentsCurrent liabilities include trade payables current tax payable accrued expenses and other short-term obligations. The Current Ratio formula is Current Assets Current Liabilities.

It indicates the financial health of a company. Why is it computed. Solvency ratio After Tax Net Profit Depreciation Total liabilities.

It compares a firms current assets to its current liabilities and is expressed as follows- The current ratio is an indication of a firms liquidityAcceptable current ratios vary from industry to industry. Working capital generally refers to the money a company has on hand for everyday operations and is calculated by subtracting current liabilities from current assets. Find the current ratio.

The formula for the current yield of a bond can be derived by using the following steps. Current Ratio Current Assets Current Liabilities. As stated by Investopedia acceptable solvency ratios vary from industry to industry.

The formula for the current ratio is. The higher the current ratio the stronger a companys short-term financial position is. The ratio considers the weight of total current assets versus total current liabilities.

Current assets less current liabilities working capital the relatively liquid portion of an enterprise that serves as a safeguard for meeting unexpected obligations arising within the ordinary operating cycle of the business. The working capital ratio also called the current ratio is a liquidity ratio that measures a firms ability to pay off its current liabilities with current assets. After determining current assets and current liabilities plug your answers into the basic current ratio formula of current assets divided by current liabilities.

Firstly determine the annual cash flow to be generated by the bond based on its coupon rate par value and frequency of payment. Toll Free 1800 309 8859 91 80 25638240. The current ratio is a liquidity and efficiency ratio that measures a firms ability to pay off its short-term liabilities with its current assets.

It indicates the ability of the business to pay its current liabilities from its operations. In the example above divide the companys current assets by its current liabilities. Current ratio is computed by dividing total current assets by total current liabilities of the business.

The quick ratio is a liquidity ratio like the current ratio and cash ratio used for measuring a companys short-term financial health by comparing its current assets to current liabilities. The formula for quick ratio is. A current ratio less than one is an indicator that the company may not be able to service its short-term debt.

The current ratio is calculated using two standard figures that a company reports in its quarterly and annual financial results which are available on a companys balance sheet. The Formula for Calculating Current Ratio The current ratio is often referred to as the working capital ratio so lets start with a quick refresher on what working capital means. Quick Ratio Formula is one of the most important Liquidity Ratios for determining the companys ability to pay off its current liabilities in the short term and is calculated as the ratio of cash and cash equivalents marketable securities and accounts receivables to Current Liabilities.

Ratio analysis is broadly classified into four types. Calculation formula The current ratio is calculated by dividing current assets by current liabilities. It has mainly two types of ratio under this.

Current Ratio Formula Current Assets Current Liabilities Rs 99280 Rs 34155 290. The relationship between the price for which a unit of livestock can be sold in the commodities markets and the price of the food required. In many cases a creditor would consider a high current.

Know about current ratio formula and example. Financially sound companies have a current ratio of greater than one. You can also say that TCS has 290 times more assets than liabilities.

Quick assets refer to the more liquid types of current assets which include. What is Working Capital. The formula used for computing the solvency ratio is.

Formula to Calculate Quick Ratio. The current ratio can also give a sense of the efficiency of a companys operating cycle or its ability to turn its product into cash. This means that TCS can cover its liabilities 290 times.

Current ratio Current assets Current liabilities Short-term debt paying ability. Current Ratio Formula Current Assets Current Liablities. The current ratio is also known as the working capital ratio.

The current ratio is defined as current assets divided by current liabilities and this ratio determines if your firm has sufficient current assets to pay current liabilities. Current Ratio Formula in Excel With Excel Template Current Ratio Formula. The quick ratio or acid-test ratio is a more conservative measure of liquidity than the current ratio.

If a company has 120 current assets for every 1 of current liabilities for example the current. Compute current cash debt coverage ratio. 92000 39000 2358.

PG HA ROT 2. The current ratio also known as the working capital ratio measures the capability of a business to meet its short-term obligations that are due within a year. If for a company current assets are 200 million and current liability is 100 million then the ratio will be 200100 20.

Current cash debt coverage ratio is a liquidity ratio that measures the relationship between net cash provided by operating activities and the average current liabilities of the company. However as a general rule of thumb a solvency ratio higher than 20 is considered to be financially sound.

Calculating The Cash Ratio Abstract

What Is Current Ratio Accountingcapital

Quick Ratio And Current Ratio Commerceiets

Q A How Is The Current Ratio Calculated And Interpreted Tutor2u

Current Ratio Meaning Interpretation Formula Calculate

Financial Liquidity Ratios Current Quick And Cash Ratios Download Table

Current Ratio Appforfinance

How To Calculate Current Ratio 7 Steps With Pictures Wikihow